[Intelligence] Analysis of the development momentum of China's FPC industry! The content is very detailed (with multiple data graphs)

Date:

2017-08-01

Source:

Industry development dynamic analysis

At present, FPC products mainly enter the terminal consumer product market such as smartphones and tablet computers through display modules, touch modules, fingerprint recognition modules, etc., and some FPCs are directly supplied to the terminal consumer product market for side buttons, power buttons, etc. Therefore, the development of the above-mentioned market is closely related to the development of the FPC industry.

In recent years, the consumer electronics market, led by mobile electronic devices such as smartphones and tablet computers, has grown rapidly, which has greatly promoted the market development of FPC as its main connection accessory. At the same time, the intelligentization of automobiles has made the demand for vehicle FPCs increase faster. fast. In addition, the rapid rise of new consumer electronic product markets such as wearable smart devices and drones also brings new growth space for FPC products. At the same time, the trend of display and touch control of various electronic products has also enabled FPC to enter a broader application space with the help of small and medium-sized LCD screens and touch screens, and the market demand is increasing.

(1) Smartphone market

1) The global smartphone market maintains steady growth

Data shows that from 2013 to 2015, global mobile phone shipments were 1.8 billion, 1.89 billion and 1.98 billion, respectively. Global mobile phone shipments declined slightly in 2016, reaching approximately 1.95 billion units for the year. Global mobile phone shipments are expected to rise to 2.01 billion units in 2020.

2007-2020 global mobile phone shipment forecast

Source: public data compilation

The rapid development of the mobile phone market has created favorable conditions for the development of the FPC market, among which smart phones are the main driving force for the growth of FPC market applications.

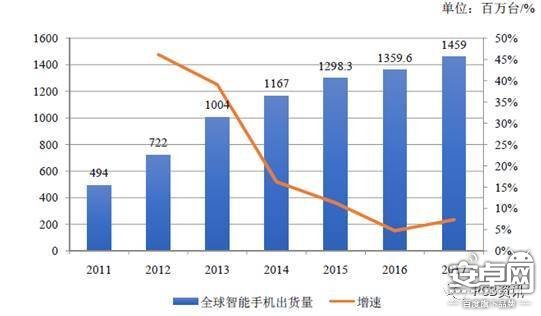

Data show that after experiencing explosive growth from 2010 to 2012, the growth rate of global smartphone shipments has slowed. Global smartphone shipments reached 1.004 billion units in 2013. From 2014 to 2016, global smartphone shipments were 1.167 billion units, 1.298 billion units, and 1.36 billion units, maintaining steady growth.

The total global smartphone shipments in 2017 are expected to be 1.459 billion units, an increase of 7.31% year-on-year, and the overall trend is still growing. In addition to being affected by the increasing shipment volume, the number and quality requirements of the built-in FPC for smartphones with a large number of functional components are also increasing, which has promoted the increase in the number of FPC applications for a single mobile phone.

Global smartphone shipments from 2010 to 2017

Source: public data compilation

2) The market share of domestic smartphones continues to increase

Source: Public data collation

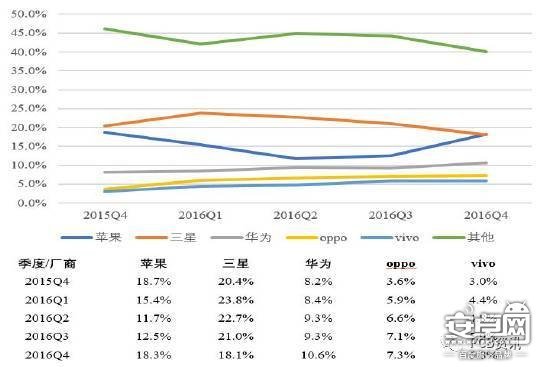

Although domestic smart phones have a certain gap with Apple, Samsung and other international well-known brands, but the domestic brands led by Huawei, OPPO, VIVO, Xiaomi, etc. by virtue of the advantages of high cost performance, personalized applications in line with customers' habits, have won the general recognition of domestic and foreign markets, and their share in the global mobile phone market has been growing.

In the fourth quarter of 2016, the global market share of Samsung and Apple decreased from more than 50 percent in 2013 to 36.4 percent. Correspondingly, the combined global market share of Huawei, OPPO and VIVO increased from 14.8 percent in the fourth quarter of 2015 to 23.7 percent, showing a trend of rapid growth.

Smartphone brand's market share in global sales volume

Source: Public data collation

Although domestic smart phones have a certain gap with Apple, Samsung and other international well-known brands, but the domestic brands led by Huawei, OPPO, VIVO, Xiaomi, etc. by virtue of the advantages of high cost performance, personalized applications in line with customers' habits, have won the general recognition of domestic and foreign markets, and their share in the global mobile phone market has been growing.

In the fourth quarter of 2016, the global market share of Samsung and Apple decreased from more than 50 percent in 2013 to 36.4 percent. Correspondingly, the combined global market share of Huawei, OPPO and VIVO increased from 14.8 percent in the fourth quarter of 2015 to 23.7 percent, showing a trend of rapid growth.

Smartphone brand's market share in global sales volume

Source: Public data collation

In the domestic market, domestic brands have more obvious market share advantages. In 2016, OPPO, Huawei and VIVO ranked the top three manufacturers in terms of domestic smartphone market share. The three companies together occupied 48% of the market share, while the three companies' market share was only 31% in 2015.

Market Share of Chinese smartphone Market by Brand in 2016 (Unit: million units /%)

Source: Public data collation

3) The development of data transmission technology has brought new growth points for the development of smart phones

At present, mobile phone data transmission has entered the 4G era. 4G technology has obvious advantages compared with 3G technology in signal transmission speed and function, and the update of 4G for smart phones has basically ended. However, with the development of technology, once 5G, 6G and other new data transmission technologies appear in the future, smart phones will face a new round of renewal wave, which brings a new growth point for the development of smart phones.

4) New technologies have expanded the use of FPC on smartphones

① Fingerprint recognition

Fingerprint identification technology is becoming more and more mature and has a huge space for development. Whether it is unlocking mobile phones, replacing passwords, or mobile payment, fingerprint identification has unlimited imagination space, which indirectly promoted the shipments of fingerprint identification FPC and became the fastest growing subdivision application field of FPC in recent years.

The global demand for fingerprint recognition is growing rapidly. In 2015, the global shipment of intelligent terminal fingerprint recognition chips reached 478 million, and the market sales volume reached 2.11 billion US dollars. It is expected that by 2018, the global intelligent terminal fingerprint identification chip market scale will reach 1.199 billion pieces, with a compound annual growth rate of about 36%, and the sales volume will reach $3.07 billion.

Global fingerprint identification chip market size and growth from 2014 to 2018

Source: Public data collation

The demand for fingerprint recognition in Chinese smartphones is also strong. In 2015, more than 30 types of smartphones released in China were equipped with fingerprint recognition function. The penetration rate of fingerprint recognition in domestic smartphones reached 25%, and the demand for fingerprint recognition modules exceeded 100 million.

As more and more mobile phone manufacturers apply the fingerprint identification function to smart phones, it is expected that in the next 5-10 years, fingerprint identification will become the standard of smart phones. It is estimated that by 2020, the penetration rate of fingerprint identification in smart phones will reach 75%, and the demand for fingerprint identification modules in China will exceed 340 million. The rapid growth of domestic demand for fingerprint identification will bring a huge incremental market for FPC fingerprint identification.

② Smart phones with flexible screens

At the beginning of 2016, researchers in Canada unveiled Reflex, the world's first flexible smartphone with a flexible screen. According to the researchers, ReFlex is the first full-color, high-resolution, wireless enabled flexible phone that will revolutionize the way users interact with their devices.

A smartphone with a flexible screen is a Reflex

Source: Public data collation

Currently in the laboratory stage, the product is expected to be mass-produced and put on the market in the next five years. It can be seen that flexibility is the development trend of smart phones in the future. The light, thin and flexible characteristics of FPC will make it get greater development in the era of flexible mobile phones.

(2) Tablet market

In 2010, Apple's iPad sparked the craze of tablet computer in the world. Tablet computer revolutionized the entire electronic product industry with its characteristics of small, convenient to carry and touch control. The rise of tablets has been another major driver of FPC market growth in recent years.

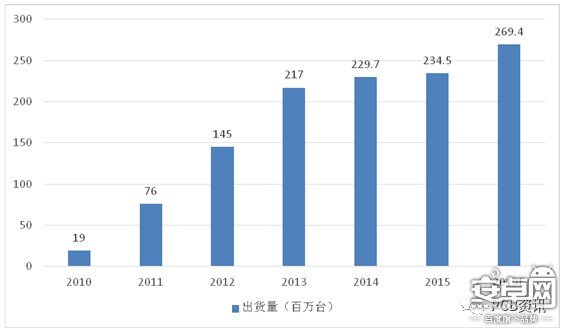

Tablet shipments rose from 19 million in 2010 to 217 million in 2013, an annual growth rate of 125.20%. After rapid growth from 2010 to 2013, tablets are likely to enter a period of steady growth in the future, with 234.5 million tablets shipped globally in 2015 and 269.4 million tablets expected to be shipped globally in 2019.

Global tablet PC Shipments and Forecast 2010-2015 and 2019E

Source: Public data collation

As a major producer of electronic products, China's tablet PC shipments are growing rapidly with the outbreak of the global tablet market. Nearly 60 million tablets were shipped in 2012, up from 65 million in 2013. According to the data, by the end of 2013, the penetration rate of tablet computers in Japan and the United States was 18% and 37%, respectively, and about 6% of the global population owned a tablet computer. According to the statistics of tablet computer sales in recent years, the current penetration rate of tablet computer in China is about 2.5%(not taking into account equipment upgrading), which is much lower than the world average level, and there is still a large market development space in the future.

In the wave of rapid development of global tablet computers, domestic brands have grown rapidly in technical strength, competitiveness and market influence. According to IDC, domestic brands such as Lenovo, Huawei and Xiaomi have been increasing their share of the tablet market as the technology and brand gap has been narrowing.

In 2014, Lenovo surpassed Amazon with a 5.6% market share to become the world's third-largest tablet by shipments. In 2015, Lenovo further consolidated its position as the world's No. 3 player, widening its market share gap with No. 4 Amazon to 2.5 percent.

With the leading domestic tablet computer manufacturers gradually establishing their position in the global market, domestic tablet computer brands have become strong competitors in the global market.

Top five brands in the tablet market 2013-2016

Source: Public data collation

The increase in shipments from tablet manufacturers has driven the rapid growth of FPC companies whose main customers are tablet manufacturers.

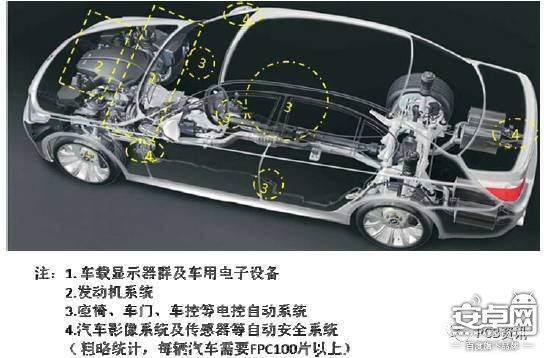

(3) Vehicle FPC market

Due to its bendability, small size and other characteristics, FPC has been widely used as a connection component in automotive ECU(Electronic Control Unit) in recent years, such as board display, audio, display and other equipment with high signal transmission capacity and high reliability requirements.

The development of science and technology has brought the automobile industry from the electronic era to the era of automation. The level of automobile intelligence has been continuously improved, and the auxiliary functions of automobile automation, power control, video and audio system have been continuously improved. Smart cars need a lot of body sensors and display screens, and carry far more electronics than ordinary cars. The global automotive electronics market is expected to reach $240 billion in 2020, up 50% from 2010.

From 2012 to 2020, the number of on-board display will increase by 233%, and in 2020, it will exceed the annual output of automobiles, reaching more than 100 million per year. The development trend of large-size and functionalization of on-board display and the increase of quantity and scale have put forward higher requirements for the quantity and quality of FPC for on-board display.

Automotive FPC main application range

Source: Public data collation

Due to the frequent work of on-board electronic products in a jitter environment, the FPC quality and stability requirements are higher. Currently, the on-board FPC market is still occupied by the world's leading FPC manufacturers such as Japan Qisheng.

(4) Emerging consumer electronics market

1) Wearable devices

With the rise of the global wearable market, large international electronic equipment manufacturers such as Google, Microsoft, Apple, Samsung and SONY have increased their investment and research and development of wearable devices. Among domestic enterprises, industry leaders such as Baidu, Tencent, Qihoo 360 and Xiaomi have also laid out their layout in the field of wearable devices. The global wearables market grew 32.6% in 2016, with China shipping more than 40 million wearable devices. Global shipments of wearable devices are expected to reach 237 million in 2020, while shipments from China are expected to reach 83 million.

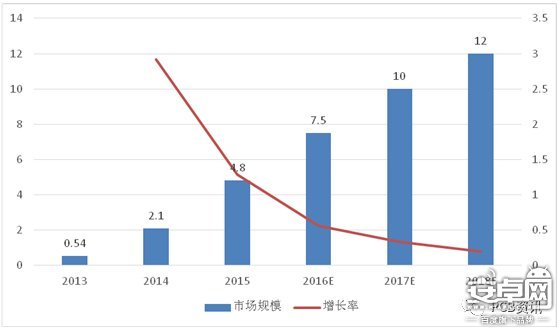

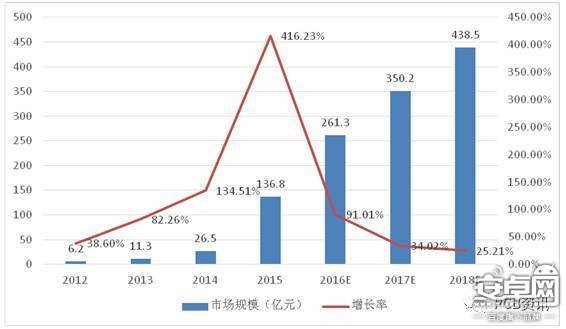

In 2014, the market entered a deep trial period, and the transaction scale of China's wearable device market reached 2.650 billion yuan. In 2015, the transaction scale of China's wearable device market sharply expanded to 13.680 billion yuan, with a growth rate of 416.20%. It is expected to maintain a relatively high growth rate from 2016 to 2018.

Market size and forecast of wearable Devices in China 2012-2018

Source: Public data collation

According to different scenarios, wearable devices have been applied to sports and health, entertainment, sleep, smart home, life, medical, military and other fields, covering a variety of product categories such as smartwatches, fitness tracking devices, smart glasses, smart clothing, medical devices, headphones, hearing AIDS and electronic watches. FPC has the characteristics of thin, flexible, and the highest fit with wearable devices, is the first choice of wearable device connection device, FPC industry will become one of the biggest beneficiaries of the booming wearable device market.

2) Consumer drones

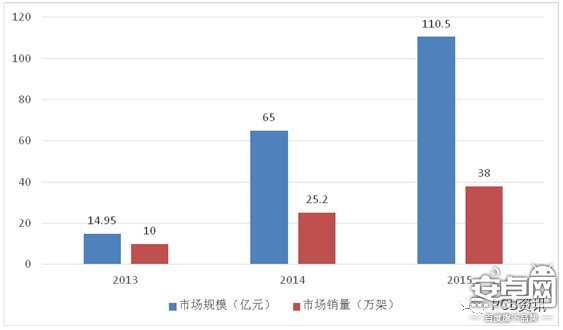

With the continuous maturity of UAV technology, civilian UAV is gradually popularized in daily life, and consumer UAV is especially popular in sales. It is mainly used in personal aerial photography and other entertainment industries, and has expanded to commercial film and television shooting and other fields.

Global consumer UAV market sales volume and scale

Source: Public data collation

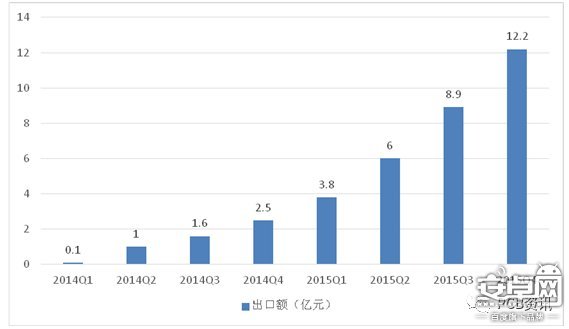

Shenzhen Customs Consumer UAV export value (RMB 100 million)

Source: Public data collation

At present, the largest sales volume in the UAV market is consumer UAV, which has witnessed rapid growth in recent years and strong demand in the global market. The global sales volume of consumer UAVs increased from 100,000 in 2013 to about 380,000 in 2015, and the market size increased from 1.495 billion yuan in 2013 to 11.050 billion yuan in 2015, with an annual compound growth rate of 171.87%. China's export of consumer drones is also growing rapidly. According to the export data of Shenzhen Customs, the export of consumer drones of Shenzhen Customs increased from 0.1 million yuan in the first quarter of 2014 to 1.22 billion yuan in the fourth quarter of 2015, realizing a rapid growth.

Many representative companies have emerged in China's UAV industry chain, and even a number of world-class companies have emerged in terms of consumer UAV. In the latest ranking of global UAV companies, there are four domestic companies on the list, which are DJI Innovation (1st), Zero Intelligent Control (5th), Jifei (7th) and Zhendi Technology (9th). China's consumer UAV has manufacturing advantages and a broad market space. As the core components of UAV are required to be light and light, the FPC is in great demand. The FPC consumption of a UAV is more than 10 pieces, among which the most core FPC is the motherboard of the aerial stabilizer camera holder.

(5) Small and medium-sized display market and touch screen market

At present, the application fields of display screen and touch screen are more concentrated in the above-mentioned smart phone, tablet computer and other markets. However, with the emergence of smart home and other products, the demand for display and touch control will extend to all areas of life. FPC can rely on the display screen market and touch screen market to enter a broader application field. The future development of these two industries will also drive the development of the FPC industry.

1) Small and medium-sized display screen

The ActiveArea (AA) area has a diagonal length of less than 10 inches. It is mainly used in various consumer electronic products. Global shipments of small and medium size panels are expected to reach 3.07 billion in 2016, according to NPD DisplaySearch. As an important connection device between the small and medium size display and the motherboard, FPC is positively correlated with the small and medium size display market.

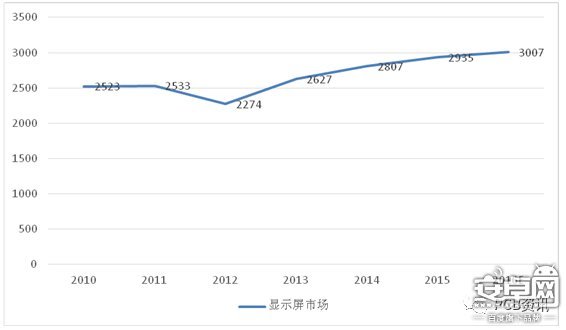

Small and medium size display market from 2010 to 2016

Source: Public data collation

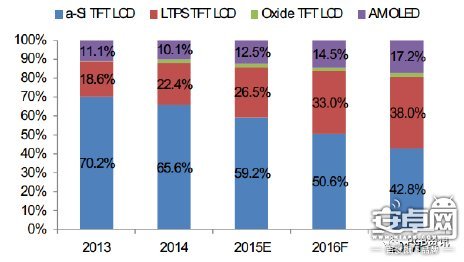

As a display component, the main change is the increasing resolution and stability. In 2013, high-end smartphones typically had 720P(HD) resolution, but in 2015, smartphones have fully entered the era of 1080P(FHD). Currently, the mainstream high-end display module solutions are LTPS-TFT LCD(Low Temperature Poly-silicon) and AMOLED(Active-matrix Organic Light-Emitting Diode). Active Matrix organic light-emitting diodes), LTPS used by iphones and most brands, and AMOLED used by Samsung.

With the rapid penetration of high resolution in mid-range phones, LTPS shipments are expected to be around 550 million pieces in 2015, 711 million pieces in 2016 and 844 million pieces in 2017, with year-on-year growth of 29.4% and 18.6% respectively. It will account for 33% and 38% of all mobile display module shipments, respectively.

Similarly, the success of AMOLED in Samsung phones has led to rapid adoption among display module manufacturers. AMOLED shipments are expected to rise to 17.2% in 2017, and together with LTPS, they account for 65.2% of all display module shipments. That's up from 29.7 percent in 2013 and 39.0 percent in 2015.

Share of global mobile display module technology shipments from 2013 to 2017

Source: Public data collation

No matter what kind of solution requires FPC line width, line spacing more fine, smaller aperture, put forward higher requirements for the FPC industry.

2) Touch Screen Market (CTP)

As one of the latest electronic consumer input accessories, touch screen is one of the most simple, convenient and natural human-computer interaction methods. Touch screen is an electronic screen that provides touch control function, and display screen is an electronic screen that provides display function, respectively requiring an independent FPC to connect with other electronic components. Taking capacitive touch screen (CTP) as an example, the touch circuit is in the high frequency working state, and its data transmission needs to rely on the excellent conductivity and heat resistance of FPC.

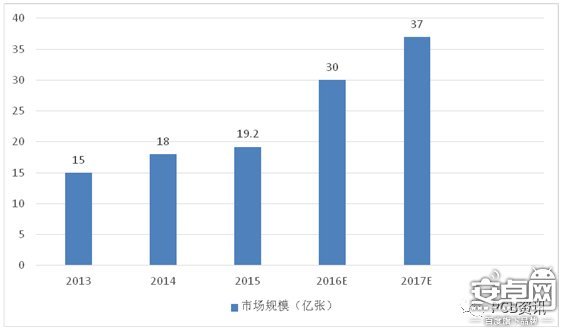

The popularity of smart terminal products has driven the rapid growth of the touch screen industry. In 2014, the global touch screen shipments reached nearly 1.8 billion pieces, with a year-on-year growth of about 20%. The touch screen has become the most critical technology in the intelligent terminal system, and its penetration in all aspects of industry, commerce and social life continues to deepen.

It is expected that by 2017, global touch screen product shipments are expected to reach 3.5 to 4 billion pieces/year.

Global touchscreen market size from 2013 to 2017

Source: Public data collation

Demand for emerging consumer electronics will continue to grow at a high rate in the coming years, driving shipments of small and medium size display modules and touch modules, which will indirectly drive FPC market demand.

-- Source: China Industrial Development Research Network, edited by PCB industry integration of new media, reproduced, please indicate the source

This article comes from: http://news.hiapk.com/internet/s5919167492b5.html

Related News

Scan your phone

Copyright © 2022 Boluo County Jinghui Electronic Technology Co., Ltd.

Boluo County Jinghui Electronic Technology Co., Ltd.

Huizhou City, Guangdong Province, Bo Luoxian County town of Jiutan Fuling Industrial TEL:86-752-6982880 FAX:86-752-6982833

Power by:www.300.cn | SEO